EUR/USD flirts with daily highs around 1.1820

- EUR/USD’s upside puts the 1.1820 area to the test.

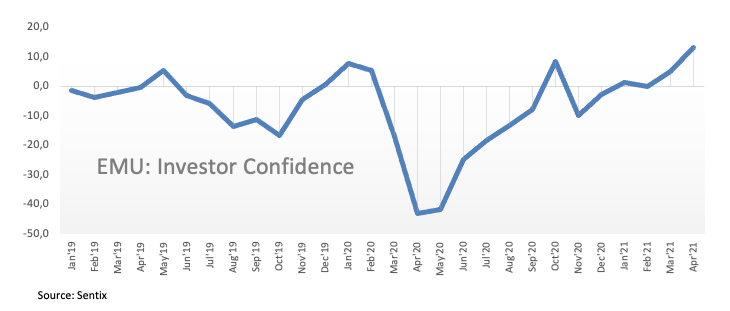

- The EMU’s Sentix Index improved to 13.1 in April.

- US IBD/TIPP Index, JOLTs Job Openings next in the NA session.

The single currency sticks to daily gains vs. the greenback and motivates EUR/USD to keep business above the 1.1800 level for the time being.

EUR/USD now targets the 200-day SMA

EUR/USD adds to gains recorded at the beginning of the week above the 1.1800 mark, although the upside momentum seems to have met some decent resistance in the 1.1820 area on turnaround Tuesday.

In the meantime, markets return to the normal activity following the Easter holidays and always with the usual suspects as main driver behind the price action in the pair, namely, the slow pace of the vaccine campaign in the Old Continent (vs. the US, for instance), new lockdown measures and the consequent impact on growth prospects for the next months.

In the euro docket, the Investor Confidence tracked by the Sentix index bettered to 13.1 for the current month, while the Unemployment Rate in the euro area failed to meet expectations and stayed put at 8.3% during February.

Data across the pond include the IBD/TIPP Index, JOLTs Job Openings and the weekly report on crude oil supplies by the API.

What to look for around EUR

EUR/USD met some decent resistance in the vicinity of 1.1820 in the first half of the week. The strong pullback in the pair seen as of late came along the persistent bid bias in the greenback, which has been undermining the constructive view in the pair in the past weeks. The deterioration of the morale in Euroland coupled with the poor pace of the vaccine rollout in the region vs. the solid performance of the US economy have all been collaborating with the renewed offered stance around the single currency. However, the steady hand from the ECB (despite some verbal concerns) in combination with the expected rebound of the economic activity in the region in the post-pandemic stage is likely to prevent a much deeper pullback in the pair in the longer run.

Key events in the euro area this week: ECB Accounts (Thursday).

Eminent issues on the back boiler: Asymmetric economic recovery in the region. Sustainability of the pick-up in inflation figures. Progress of the vaccine rollout. Probable political effervescence around the EU Recovery Fund.

EUR/USD levels to watch

At the moment, the index is gaining 0.08% at 1.1819 and faces the next hurdle at 1.1875 (200-day SMA) followed by 1.1989 (weekly high Mar.11) and finally 1.2000 (psychological level). On the downside, a breach of 1.1704 (2021 low Mar.31) would target 1.1602 (monthly low Nov.4) en route to 1.1573 (2008-2021 support line).