Back

15 Mar 2021

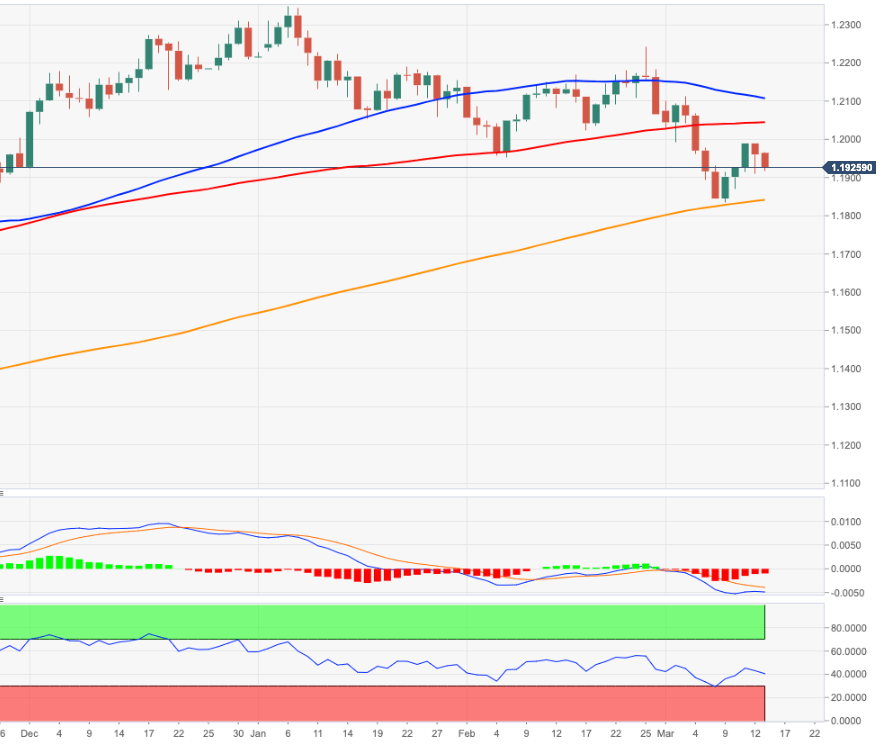

EUR/USD Price Analysis: Extra losses could see the YTD low revisited

- EUR/USD extends the rejection from recent tops and approaches 1.19.

- A deeper pullback could re-test the YTD low in the 1.1830 region.

The bull run in EUR/USD met a tough barrier in the vicinity of the psychological 1.20 hurdle in the second half of last week, triggering the ongoing corrective downside.

The continuation of the offered bias could motivate EUR/USD to attempt another visit to the 2021 lows in the 1.1835/30 band (March 9) in the near-term. This area of lows is reinforced by the proximity of the key 200-day SMA, today at 1.1831.

Below the latter, potential losses are expected to gather further steam with the next target at the 2008-2020 support line in the 1.1600 area. This scenario, however, is not favoured for the time being.

EUR/USD daily chart