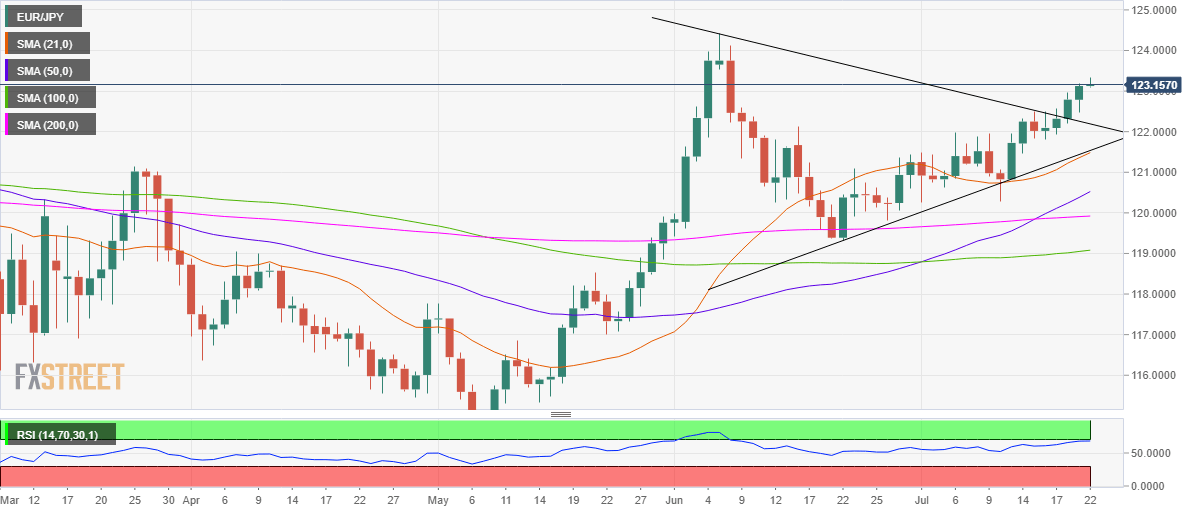

EUR/JPY Price Analysis: Bullish bias remains intact amid symmetrical triangle breakout

- EUR/JPY off six-week highs, but upside bias still intact.

- Symmetrical triangle breakout on the daily chart targets 127.

- Daily RSI lies just under overbought territory, bullish.

Despite a quick drop from six-week highs of 123.34, the underlying bullish momentum in EUR/JPY remains intact, as highlighted by the daily technical chart.

The cross spotted a symmetrical triangle breakout on Monday and since then has rallied nearly 1.5 big figures.

The further upside looks likely, with the pattern target around 127 zone in sight, in absence of healthy resistance levels. Meanwhile, the daily Relative Strength Index (RSI) stays bullish just under the overbought territory, suggesting additional gains.

The spot could test the May high at 124.43 before marching towards the 127 mark.

Any pullbacks will meet fresh demand near the falling trendline resistance-turned-support, now aligned at 122.19.

The next support awaits at the confluence of the rising trendline support and upward-sloping 21-daily Simple Moving Average (DMA) at 121.50.

EUR/JPY Daily Chart

EUR/JPY Additional levels