Back

26 Jun 2020

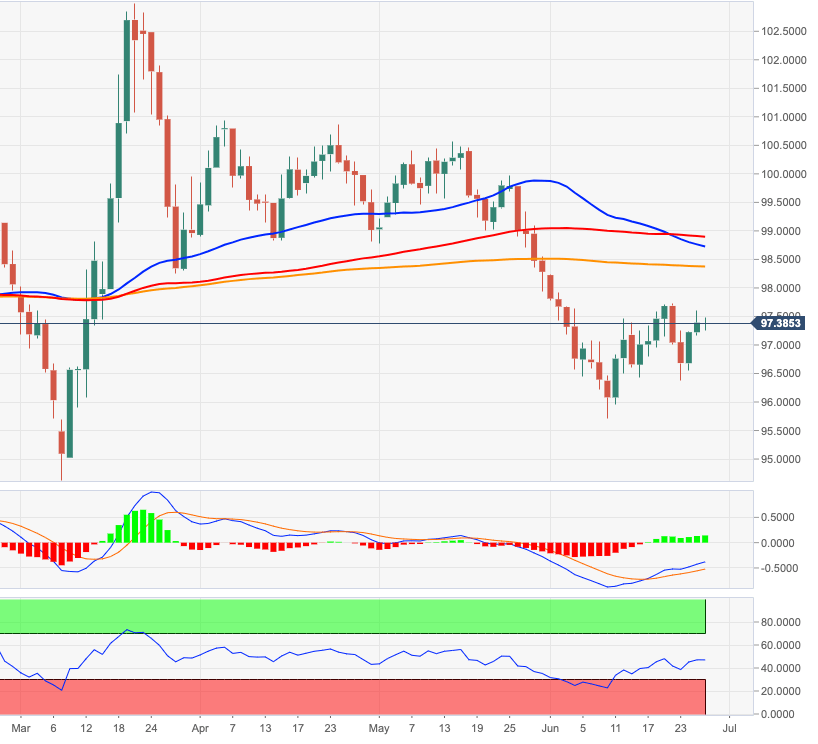

US Dollar Index Price Analysis: The 200-day SMA still caps the upside

- DXY’s rebound faces a tough barrier at the 97.90 region so far.

- Interim resistance aligns at the Fibo level at 97.87.

DXY has managed to regain composure after bottoming out in the 96.40 zone earlier in the week.

Bulls now appear in control and could lift the index to the area of 97.90, where coincide monthly peaks and a Fibo retracement (of the 2017-2018 drop).

As long as the 200-day SMA, today at 98.36, caps the upside, further losses are still on the table for the dollar.

DXY daily chart