US Dollar Index on the defensive near 99.70, FOMC in sight

- DXY remains offered in the 99.70 region on Wednesday.

- Focus stays on the potential re-opening of the US economy.

- The Fed is expected to leave rates unchanged at the meeting.

The greenback, in terms of the US Dollar Index (DXY), is extending the bearish note so far this week, navigating the 99.70 region at the time of writing.

US Dollar Index supported near the 55-day SMA

The index has come under renewed downside pressure so far this week following another rejection from the boundaries of 101.00 the figure in past sessions.

Indeed, the dollar is retreating for the fourth consecutive session on Wednesday, losing ground as of late amidst renewed scepticism on the timing and shape of the re-opening of the US economy.

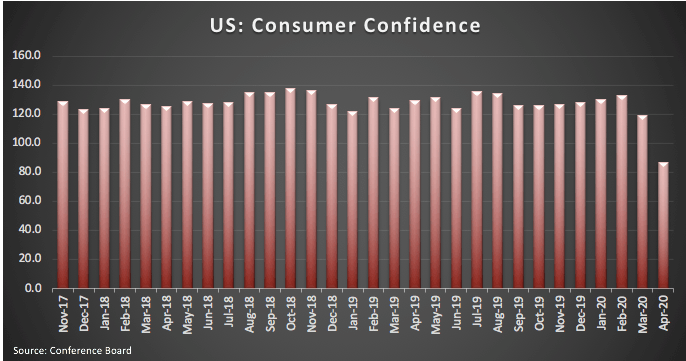

In addition, the key Consumer Confidence gauged by the Conference Board dropped to 86.9 in April, collaborating with the selling mood in the buck.

Later on Wednesday, the FOMC is expected to leave rates unchanged although the focus of attention has moved to Chief Powell’s press conference and any changes on the Fed’s forward guidance.

What to look for around USD

The dollar’s rally lost momentum once again in the vicinity of 101.00, where sellers re-emerged and dragged DXY back to the area below the 100.00 mark. In the meantime, all the attention remains on the coronavirus developments against the backdrop of increasing efforts by the country to re-open the economy, albeit at a gradual pace. On the supportive side of the dollar remains its status of “global reserve currency”, store of value and the investors’ preference when comes to seek refuge amidst financial stress. In the very near-term, the Fed’s forward guidance should remain on top of the debate at the FOMC event later on Wednesday.

US Dollar Index relevant levels

At the moment, the index is losing 0.67% at 99.67 and faces the next support at 99.45 (weekly low Apr.28) followed by 99.30 (55-day SMA) and then 98.82 (monthly low Apr.15). On the upside, a break above 100.49 (78.6% Fibo of the 2017-2018 drop) would aim for 100.93 (weekly/monthly high Apr.6) and finally 101.34 (monthly high Apr.10 2017).