EUR/USD Price Analysis: Single currency has erased more than 75% of its recent rally

- EUR/USD fell to 1.10955 on Tuesday, erasing 76% of the recent rally.

- Tuesday's big red candle indicates scope for deeper losses.

EUR/USD has erased a significant chunk of the recent rally and looks set for a deeper drop in the short-term.

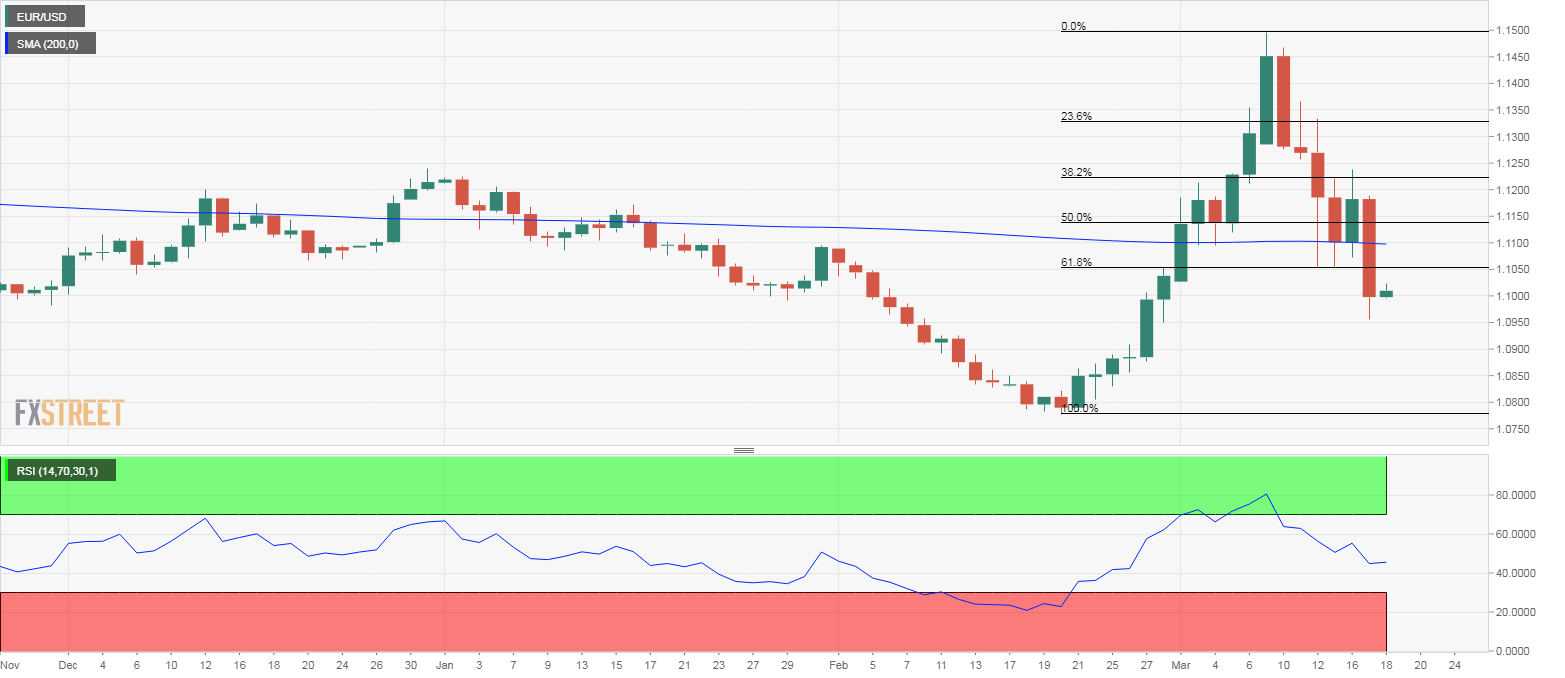

The pair is currently trading just above 1.10, having hit a low of 1.0955 on Tuesday. At that level, nearly 76% of the rally from 1.0778 to 1.1495 witnessed in the 12 days to March 3 stood erased.

From a technical perspective, the market sentiment looks to have turned quite bearish. The pair produced a big red candle on Tuesday with small wicks - a sign the sellers were in control from the UTC open to UTC close.

The spot also closed under 1.1052 on Tuesday, violating the 61.8% Fibonacci retracement of the rally from 1.0788 to 1.1495. The pair has also found acceptance under the 200-day average, currently located at 1.1097.

Meanwhile, the 14-day relative strength index (RSI) has dropped into the bearish territory below 50.

All in all, the odds appear stacked in favor of a slide to 1.09, under which major support is seen directly at 1.0778.

On the higher side, a close above Tuesday's high of 1.1189 is needed to put the bulls back into the driver's seat.

Daily chart

Trend: Bearish

Technical levels