Back

6 Dec 2019

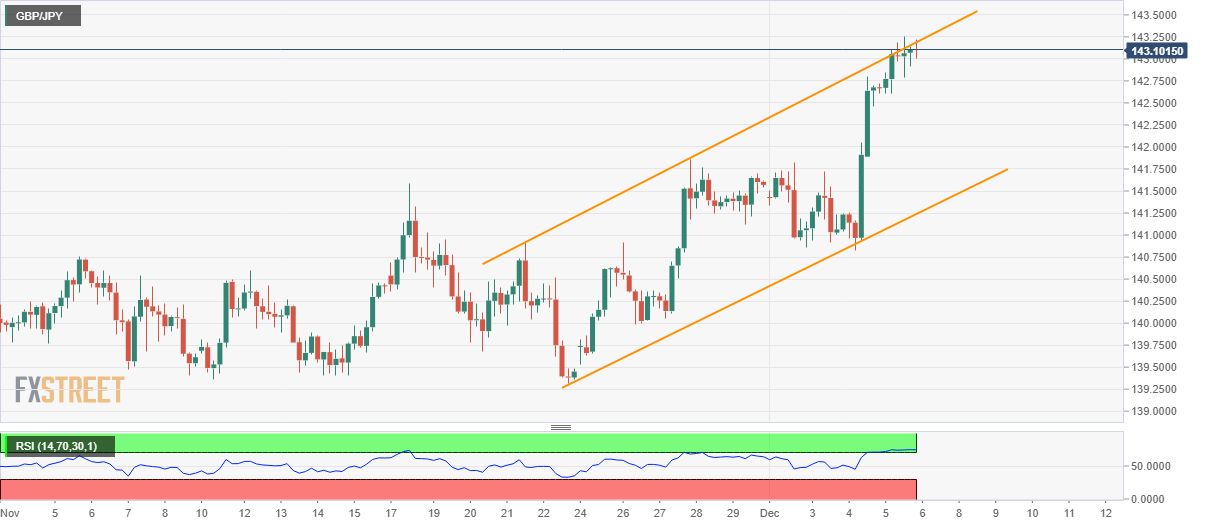

GBP/JPY Technical Analysis: Pulls back from rising channel’s resistance amid overbought RSI

- GBP/JPY fails to defy the two-week-old rising channel.

- Overbought RSI conditions can trigger pullback to late-November high.

- Lows marked in March and April months could lure buyers during further upside.

GBP/JPY seesaws around 143.00 during the Asian session on Friday. In doing so, the pair steps back from resistance line of a short-term ascending trend-channel.

In addition to its pullback from the channel’s resistance line, overbought conditions of 14-bar Relative Strength Index (RSI) also push sellers to look for entry while targeting November 27 top close to 141.85.

During the pair’s additional declines below 141.85, November 18 high near 141.55 and channel support near 141.20 becomes the key to watch.

On the contrary, pair’s run-up beyond the latest high around 143.25 could escalate the north-run to March/April lows near 143.72/80.

GBP/JPY 4-hour chart

Trend: Pullback expected