Back

12 Feb 2019

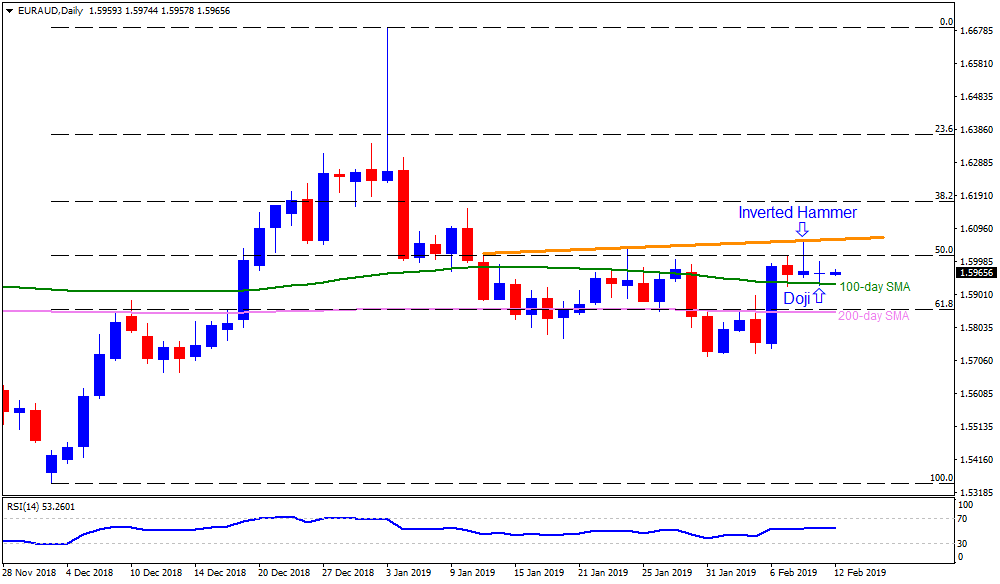

EUR/AUD Technical Analysis: Inverted hammer at 50% Fibo guards upside, although doji confirms traders’ indecision

- The EUR/AUD pair trades little positive around 1.5970 during the early Asian sessions on Tuesday.

- Daily chart confirms traders’ indecision on Monday’s “Doji” candle after guarding the upside by Friday’s “Inverted Hammer”.

- While “inverted hammer” supports the claim of consolidation considering across the board USD strength, “doji” portrays traders’ dilemma.

- The 100-day simple moving average (SMA) at 1.5930 can offer immediate support to the pair before diverting market attention to the 1.5855-50 support-zone, including 61.8% Fibonacci Retracement of its December-January surge.

- In case prices slip under 1.5850 on a daily closing basis, the 1.5730 and the 1.5670 may come back on the chart.

- Alternatively, 50% Fibonacci retracement level of 1.6015 seems adjacent upside barrier for the pair, a break of which can propel the quote to upward sloping resistance-line at 1.6065.

- During the pair’s successful rise over 1.6065, the 1.6100 and the 1.6185 may please the buyers.

EUR/AUD daily chart