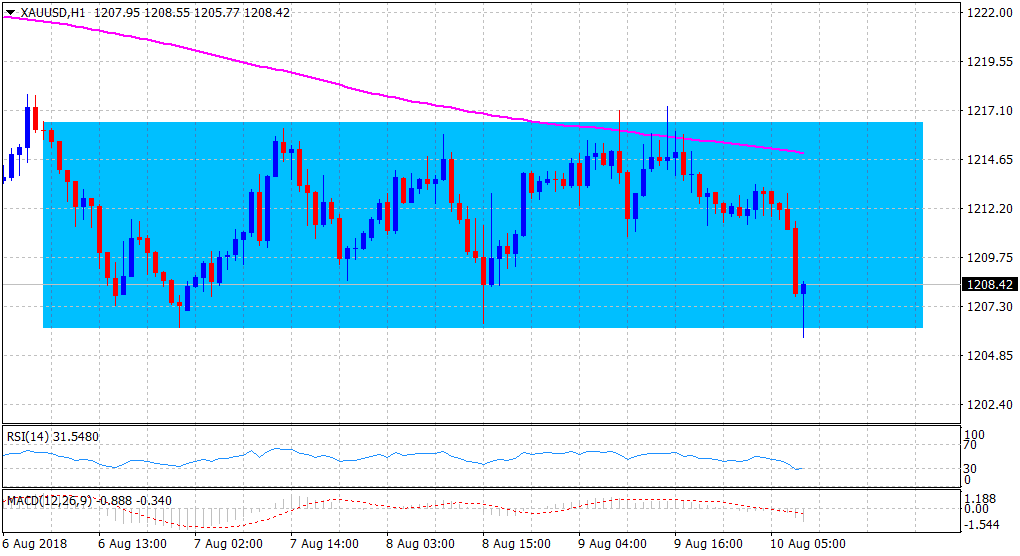

Gold Technical Analysis: Retests weekly trading range support

• The precious metal extended overnight rejection slide from 200-hour SMA and dropped to test the lower end of its weekly trading range in the last hour.

• A strong follow-through USD buying interest was seen as one of the key factors exerting some fresh selling pressure around the dollar-denominated commodity.

• A convincing break through the rectangular chart pattern formation should open room for the resumption of the commodity's well-established bearish trend.

• Technical indicators on the 1-hourly chart have started drifting into oversold territory and might be the only factor to help limit deeper losses ahead of today's US CPI figures.

Gold 1-hourly chart

Spot Rate: $1208.42

Daily High: $1213.38

Daily Low: $1205.77

Trend: Range-bound

Resistance

R1: $1213 (current day swing high)

R2: $1217 (weekly high set on Monday)

R3: $1228 (July 31 swing high)

Support

S1: $1205 (17-month low set last Friday)

S2: $1200 (psychological round figure mark)

S3: $1195 (March 2017 swing low)