Back

17 Jul 2018

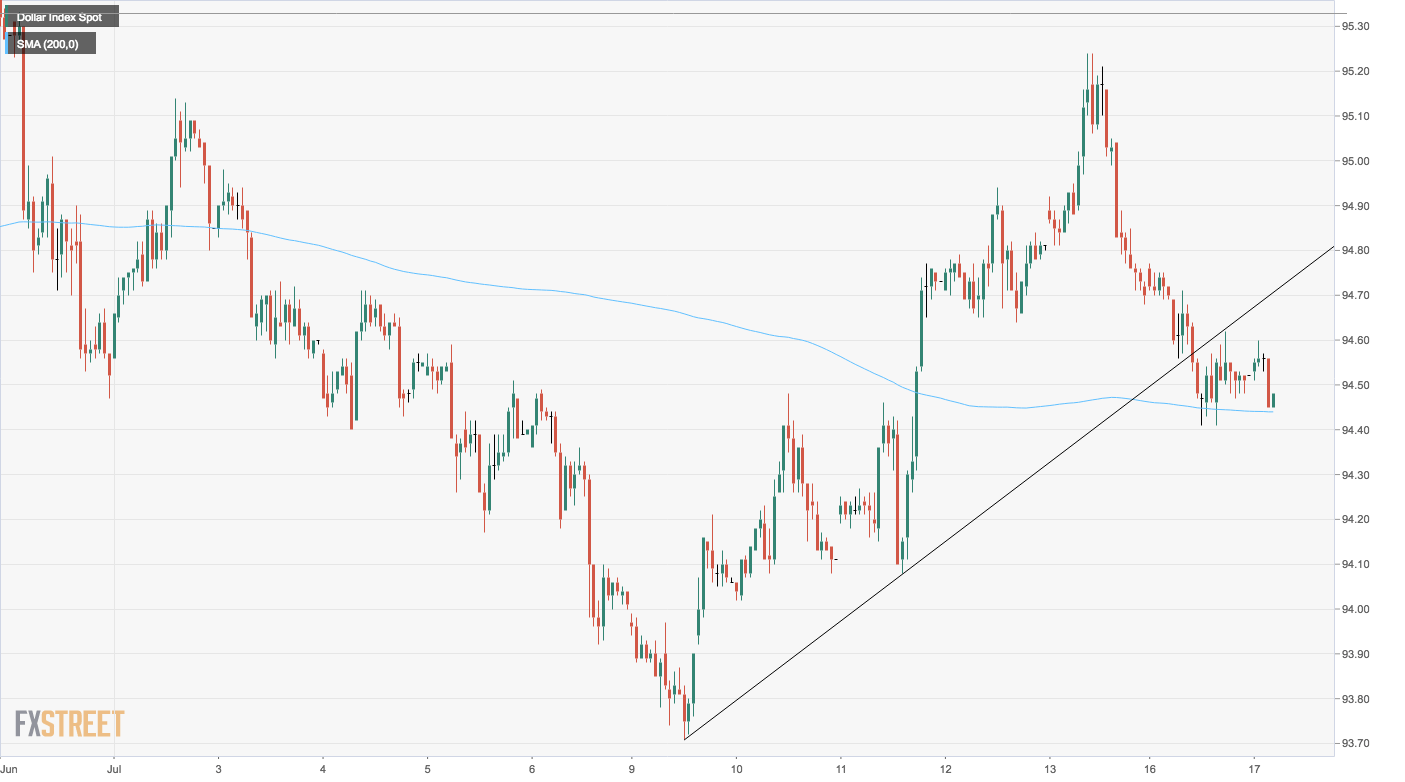

Dollar Index Technical Analysis: On the defensive, nears 200-hour MA support

- The dollar index (DXY) risks falling below the 200-hour moving average, currently located at 94.42, having breached the rising channel yesterday.

- The hourly relative strength index (RSI) is also biased toward the bears.

Hourly Chart

Spot Rate: 94.45

Daily High: 94.60

Daily Low: 94.44

Trend: Bearish

Resistance

R1: 94.65 (100-hour moving average)

R2: 95.24 (July 13 high)

R3: 95.53 (June 28 high)

Support

S1: 94.13 (50-day moving average)

S2: 93.71 (July 9 low)

S3: 93.19 (June 14 low)