Back

6 Mar 2018

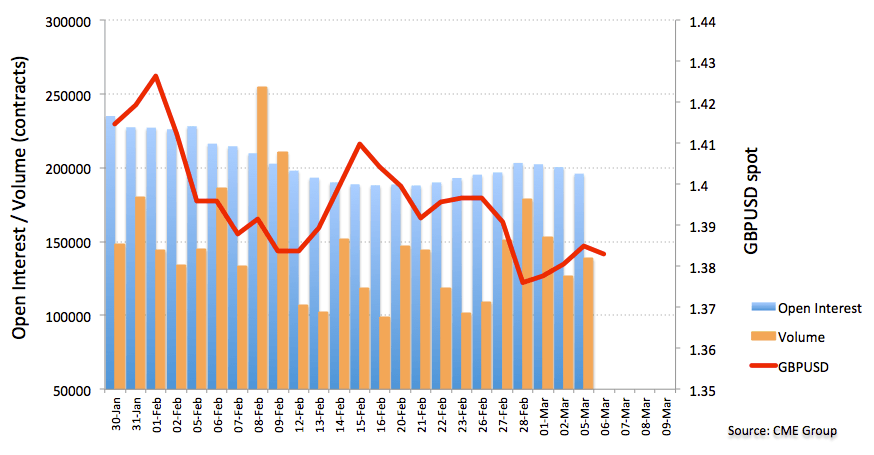

GBP futures: extra gains unlikely near term

In light of CME Group’s preliminary data for GBP futures markets, open interest decreased by more than 4.4K contracts on Monday - recording the third consecutive drop – vs. Friday’s 200,472 contracts. On the opposite side, volume rose by more than 12.1K contracts after two consecutive drops.

GBP/USD remains under pressure below 1.4030/70

Cable is struggling for direction today after three sessions in a row with gains. Shrinking open interest against the backdrop of declining volume are removing tailwinds from the current uptick in prices, leaving the outlook on GBP/USD fragile as long as it trades below the 1.4070/30 band, where converge February 26 high and the resistance line off 2018 tops.