USD/JPY down 90-pips off highs; US dollar erased daily gains

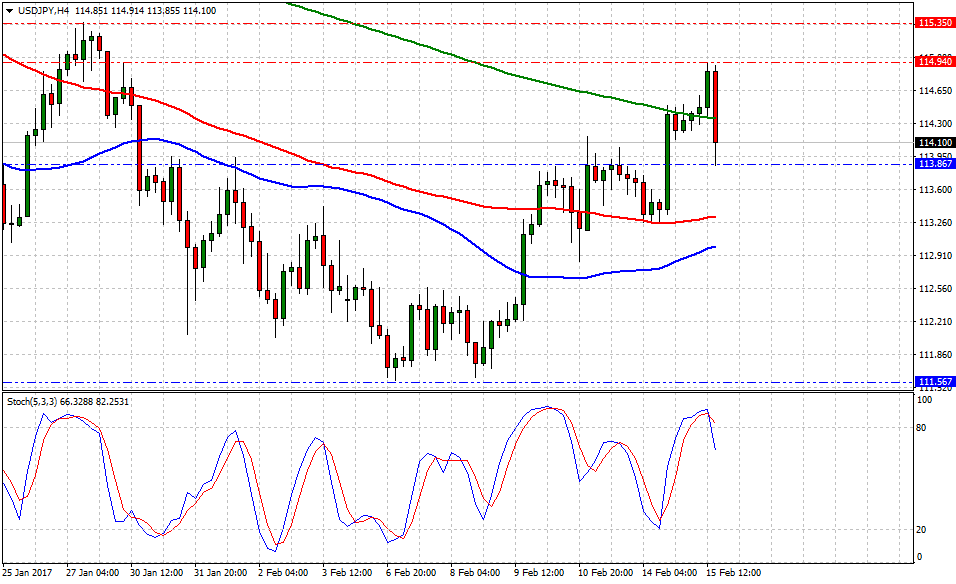

Currently, USD/JPY is trading at 114.16, down marginally -0.10% or (11)-pips on the day, having posted a daily high at 114.95 and low at 113.86.

Today's NA trading session started as a 'big happy smile' for dollar bulls due to roaring US data figures and some hawkish words handed by Fed's Yellen during her 'Congressional testimony.' However, as wise words read 'expect the unexpected' when the pair suddenly crashed below 200-SMA close to 90-pips from the session's high.

Fedwatch, CME Group tool to predict rate hikes probability, seems to increase to 26.6% from 17.7% on the previous day; Is the market really expecting a sooner rather than later move from the Fed?

USD/JPY positive above 113.20 – UOB

Historical data available for traders and investors indicates during the last 7-weeks that USD/JPY pair had the best trading day at +1.76% (Jan.18) or 201-pips, and the worst at -1.65% (Jan.05) or (190)-pips.

Technical levels to consider

In terms of technical levels, upside barriers are aligned at 114.95 (high Feb.15) and above that at 115.36 (high Jan.27). While supports are aligned at 113.86 (low Feb.15), later at 113.31 (100-SMA) and finally below that at 113.00 (50-SMA).

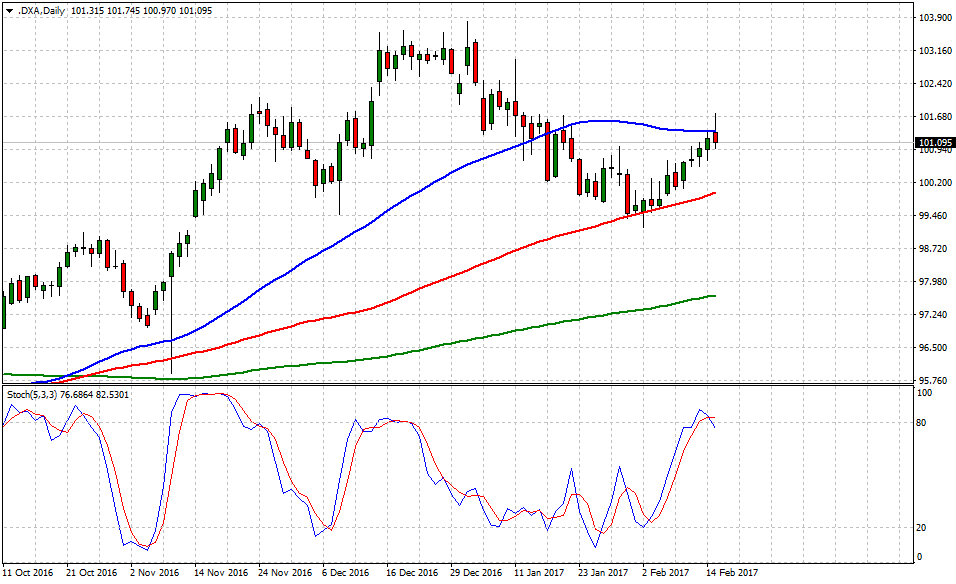

The greenback – gauged by the US Dollar Index seems muted 'at 50-DMA gates' which contributed to a sell-off across the board. However, the bullish tone hasn't been diluted as long as the buck holds 100.20 handle.

USD/JPY analysis: upward potential limited below 114.55