USD/CHF trapped between 50-DMA and 100-DMA; US dollar uptrend 'seems' alive

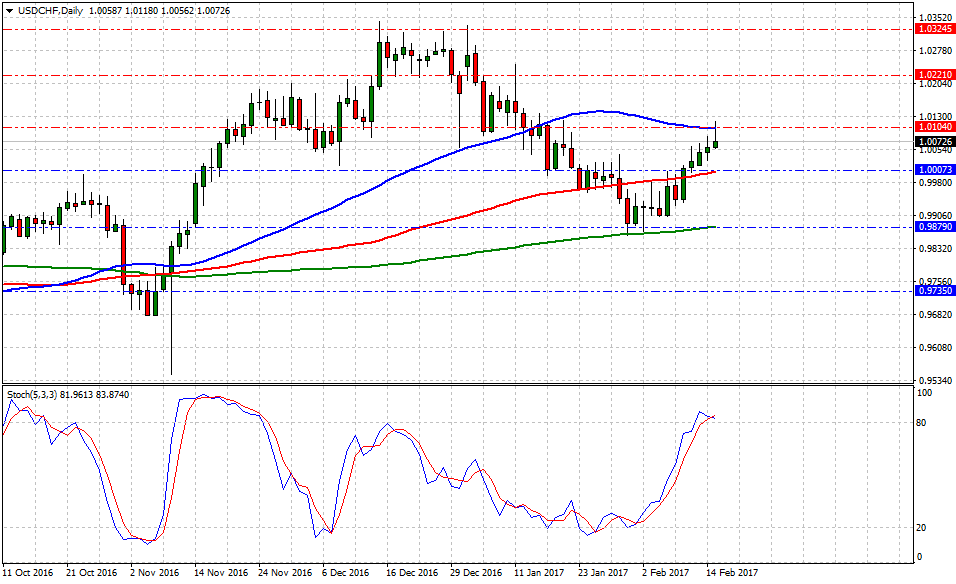

Currently, USD/CHF is trading at 1.0070, up +0.10% or 10-pips on the day, having posted a daily high at 1.0118 and low at 1.0056.

Today's US economic docket added the necessary elements to boost the greenback to higher highs in a much-anticipated trading week. Furthermore, a steady Consumer Price Index (YoY) figure at 2.5% spiced things enough for the American dollar vs. Swiss franc as markets participants moved away from 'safe-havens' to take more risk jumping into the dollar-long narrative.

Historical data available for traders and investors indicates during the last 7-weeks that USD/CHF pair had the best trading day at +0.80% (Jan.6) or 81-pips, and the worst at -1.05% (Jan.5) or (105)-pips.

Technical levels to watch

In terms of technical levels, upside barriers are aligned at 1.0103 (50-DMA), then at 1.0219 (high Jan.5) and above that at 1.0320 (high Dec.28). While supports are aligned at 1.005 (100-DMA), later at 0.9880 (200-DMA) and finally below that at 0.9734 (low Nov.8).

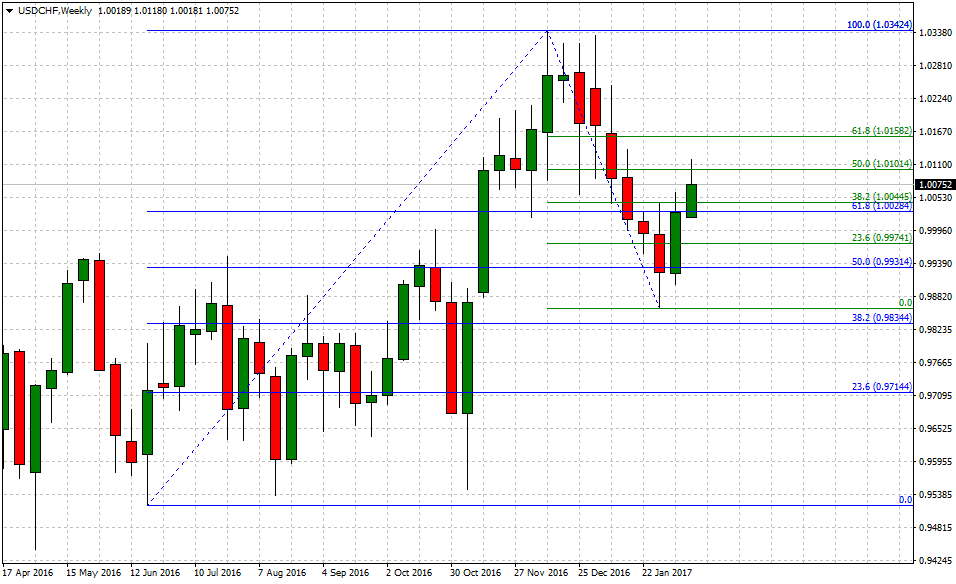

On the long-term view, upside barriers are aligned at 1.0101 (short-term 50.0% Fib) and above that level at 1.0158 (short-term 61.8% Fib). While supports are aligned at 1.0044 (short-term 38.2% Fib), later at 1.0028 (long-term 61.8% Fib) and below that at 0.9974 (short-term 23.6% Fib).

EUR/USD: greenback boosted by strong data