The Moving Average and RSI crossover strategy

This trend-following strategy from our expert Manish Patel will help you improve your trading performance. You can use it for trend trading, day trading, and scalping.

Level: beginner and intermediate

Timeframe: M15 (M5 for aggressive traders)

Currency pairs: majors (EURUSD preferable)

Market state: continuation (preferable)

Required indicators:

● 3 EMAs (10, 20, 50)

● RSI (14), RSI levels (10, 45, 50, 55, 90)

Take your profit with a risk/reward ratio of 1:1.5, 1:2, or 1:3.

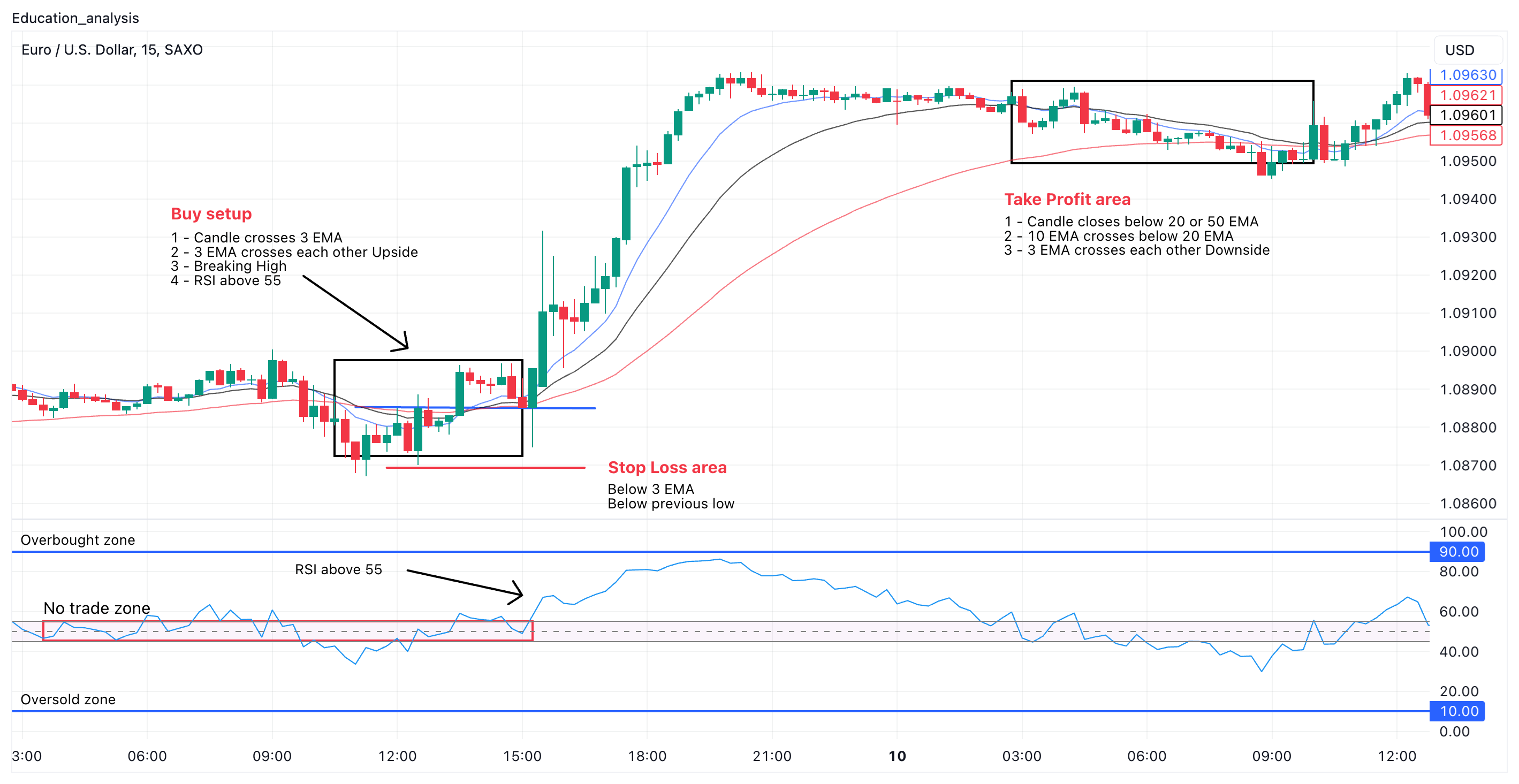

Here is a simple setup of 3 EMAs and RSI, along with price levels (S&R zones, trendlines on an H1 timeframe) and an M15 trading timeframe.

You can use this simple setup to trade on an M15 timeframe to get from 10 to 60 pips with the Stop Loss 10-20-30 pips.

Level: beginner and intermediate

Timeframe: M15 (M5 for aggressive traders)

Currency pairs: majors (EURUSD preferable)

Market state: continuation (preferable)

Required indicators:

● 3 EMAs (10, 20, 50)

● RSI (14), RSI levels (10, 45, 50, 55, 90)

The Buy order setup

Take ProfitTake your profit with a risk/reward ratio of 1:1.5, 1:2, or 1:3.

Here is a simple setup of 3 EMAs and RSI, along with price levels (S&R zones, trendlines on an H1 timeframe) and an M15 trading timeframe.

You can use this simple setup to trade on an M15 timeframe to get from 10 to 60 pips with the Stop Loss 10-20-30 pips.

Pic 1. RSI—No trade zone

Entry conditions for a long position (Buy):

To open a Buy order using this strategy, follow these steps:1. The overall market trend should move upwards (minimum 1D, 4H, or 1H timeframe).

2. Draw a trendline on a 1H timeframe or use the 50 MA to confirm an uptrend.

3. Move to the M15 timeframe.

4. Wait for all 3 EMAs to cross on the upward move and the RSI to be above 55 for a Buy order possibility.

5. Once the price crosses above the 10 EMA, after crossing the 50 EMA and the 20 EMA, and the RSI is above 55, you can execute a Buy order.

6. You can also get confirmation using such price action candlestick patterns as:

● the Bullish Marubozu

● the Bullish engulfing

● the Bullish hammer

● the Tweezer bottom

● the Inverted hammer

● the Morning Doji star

● the Bullish pin bar

● the Bullish inside bar

● the Dragonfly Doji and many other.

7. Set a minimum Take Profit of 10-15 or even 30-40 pips, or apply the Trailing Stop Loss.

Pic 2. Buy Confirmation

Pic 3. Buy Setup

Exit conditions for a long position (Buy):

There are five ways you can close your Buy order:1. Close your order as soon as your target reaches 10-15 pips, or a maximum of 30-50 pips if you haven't fixed the TP value.

2. Close your order if prices are going below and close below the 10 EMA or the 20 EMA.

3. Hold your order if you want to get maximum pips. But, once the price closes below the 50 EMA, you should close the order.

4. After you reach your target, close your order if you see the following bearish price action candlesticks:

● the Bearish Marubozu

● the Bearish engulfing

● the Shooting star

● the Evening star

● the Tweezer top

● the Hanging man

● the Bearish pin bar

● the Bearish inside bar

● the Gravestone Doji and many other.

5. Close your order if the RSI is 45-50 or going up.

Stop Loss

There are three ways you can use Stop Loss in this strategy:

1. You can use the Average True Range (ATR) formula:

((Current ATR value × 1.5) + 10 pips approximately))

2. You can set the SL 5-10 pips below the previous low from which you have executed the Buy order.

3. You can set the SL 10-20-30 pips below the 50 EMA, 10-20-30 pips below the crossing of 3 EMAs, or 10-20-30 pips below the previous low of the 50 EMA.

The Sell order setup

Take ProfitTake your profit with a risk/reward ratio of 1:1.5, 1:2, or 1:3.

Here is a simple setup of 3 EMAs and RSI, along with price levels (S&R zones, trendlines on an H1 timeframe) and an M15 trading timeframe.

You can use this simple setup to trade on an M15 timeframe to get from 10 to 60 pips with a Stop Loss of 10-20 pips.

Pic 1. RSI—No trade zone

Entry conditions for a short position (Sell):

To open a Sell order using this strategy, follow these steps:1. The overall market trend should be in downward movement (minimum 1D, 4H, or 1H timeframe).

2. Draw a trendline on a 1H timeframe or use the 50 MA to confirm a downtrend.

3. Move to the M15 timeframe.

4. Wait for all 3 EMAs to cross on the downward move and the RSI to be below 45 for a Sell order possibility.

5. Once the price crosses below the 10 EMA, after crossing below the 50 EMA and the 20 EMA, and theRSI is below 45, you can execute a Sell order.

6. You can also get confirmation using such price action candlestick patterns as:

● the Bearish Marubozu

● the Bearish engulfing

● the Shooting star

● the Evening star

● the Tweezer top

● the Hanging man

● the Bearish pin bar

● the Bearish inside bar

● the Gravestone Doji and many other.

7. Set a minimum Take Profit of 10-15 pips or even 30-40 pips, or apply the Trailing Stop Loss.

Pic 6. Sell Confirmation

Pic 7. Sell Setup

Exit conditions for a short position (Sell):

There are five ways you can close your Sell order:1. Close your order as soon as your target reaches 10-15 pips, or a maximum of 30-50 pips if you haven't fixed the TP value.

2. Close your order if prices are going above and close above the 10 EMA or the 20 EMA.

3. Hold your order if you want to get maximum pips. But, once the price closes above the 50 EMA, you should close the order.

4. After you reach your target, close your order if you see the following bullish price action candlesticks:

● the Bullish Marubozu

● the Bullish engulfing

● the Bullish hammer

● the Tweezer bottom

● the Inverted hammer

● the Morning Doji star

● the Bullish pin bar

● the Bullish inside bar

● the Dragonfly Doji and many other.

5. Close your order if the RSI is 45 or going up.

Stop Loss

There are three ways you can use Stop Loss in this strategy:

1. You can use the Average True Range (ATR) formula:

((Current ATR value × 1.5) + 10 pips approximately))

2. You can set the SL 5-10 pips above the previous high from which you have executed the Sell order.

3. You can set the SL 10-20-30 pips above the 50 EMA, 10-20-30 pips above the crossing of 3 EMAs, or 10-20-30 pips above the previous high of the 50 EMA.